Article | Budgeting

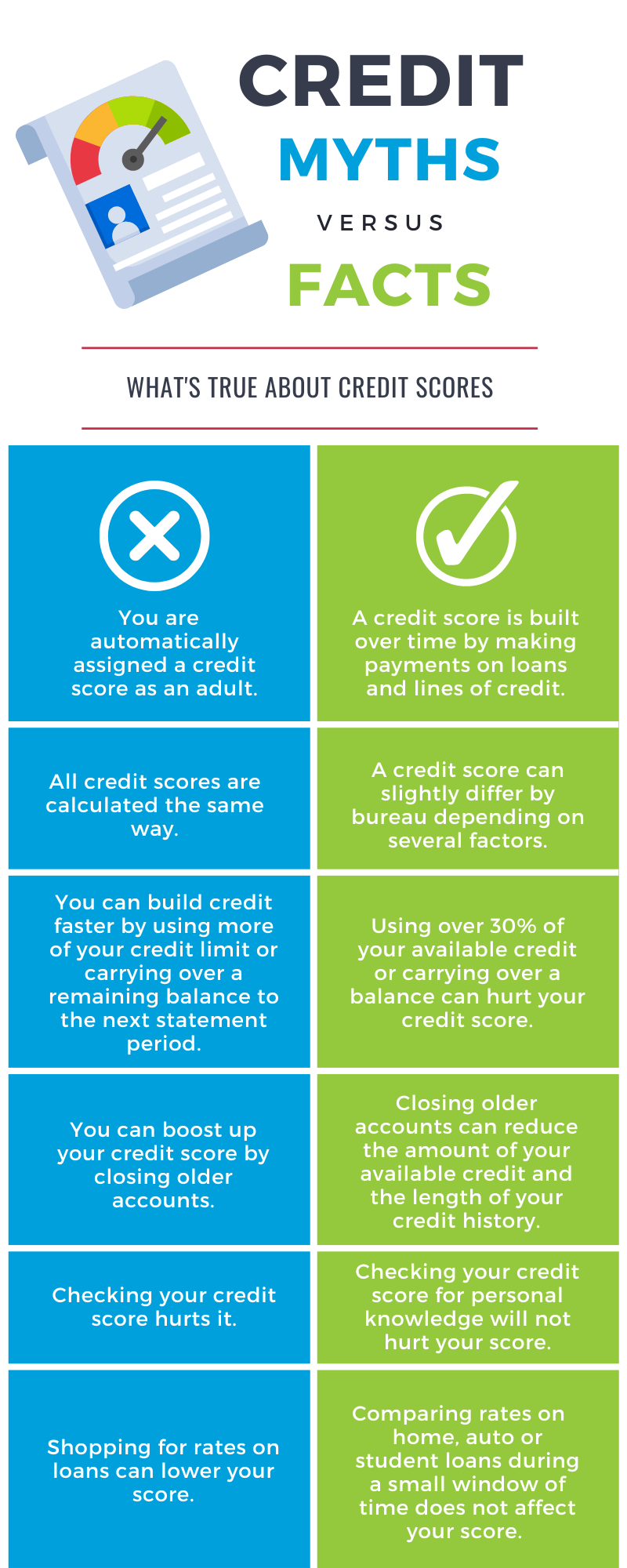

Not everything you hear about credit scores is true. We’re debunking six myths about what hurts and helps your credit score.

Your credit score can have a big impact on your life, from borrowing power to the interest rates you may qualify for. And knowing the facts can help you navigate the dos and don’ts of building and maintaining your credit. This list gets to the bottom of some common myths about what really impacts a credit score.

Some people may think they are assigned a credit score when they become an adult, but that’s not true. Credit scores are built, so if you don’t have a loan or use a credit card, you may not have enough data for a score. According to the Consumer Financial Protection Bureau, about 23% of adults in the U.S. either are considered “credit invisible,” meaning they have no credit, or can’t be scored because they have too few or new credit accounts or no significant recent activity.

Not having a credit score can make it harder to qualify for a mortgage or auto loan, or if you’re able to qualify, the interest rate may be higher. Some ways to help begin building credit are getting a secured credit card, becoming an authorized user on someone’s credit account or using a credit-builder loan.

Your credit score can slightly differ between credit bureaus for several reasons. The scoring models used, the information being provided to those bureaus and the times that information is analyzed can all affect the score provided. However, the bureaus typically factor in similar data like the length of time you’ve had your accounts open, payment history, how much of your available credit is being used and the variety of credit you have.

Actually, using a high amount of your available credit limit or carrying the balance over to the next month could hurt your credit score. Credit utilization is one of the factors that affects your score, and it is generally a good idea to avoid using more than 30% of your credit limit. For example, if you have a credit limit of $5,000 on a credit card, 30% would be $1,500. Using a higher percentage means the amount owed is larger and can signal that a person may be at risk of defaulting on payments. So, maxing out your limit could lower your credit score.

The same idea applies to having a remaining balance. Not only will that owed balance increase the credit utilization percentage but it will also accrue interest, meaning you’ll pay more than you originally borrowed in the long run. Regularly paying all of the balance each month will help improve your score over time.

There are two reasons this misconception is incorrect. First, the length of time an account has been open is part of your credit history, which affects that factor in scoring. Let’s say, for example, you have an older credit card that you don’t use often and are thinking about closing the account. If you close it, the average age of your total accounts will change, possibly lowering your score if your credit history now looks shorter.

Second, closing that account could reduce the amount of available credit you have, so your utilization percentage will likely go up. It can be a better practice to keep your older accounts open and make small purchases on them from time to time, paying the balance in full when you get your statement. That way, you keep a lengthier credit history and a lower credit utilization.

It’s a good practice to check your credit report at least yearly and review it for any errors that need to be corrected or signs of potential identity theft. Checking your own credit score is considered a “soft” inquiry, which won’t make changes to your score. However, a “hard” inquiry, like applying for a mortgage or loan, could possibly change it. You can request a free credit report every year from Annual Credit Report. Several credit and banking card companies also provide free credit scores and track any changes in their services, so be sure to ask if that is available to you.

It’s important to remember that an actual application for a loan could lower your credit score, but rate shopping for a mortgage or auto loan is different. If you are talking to different lenders for preapproval offers at the same time, typically within a specific time period, the credit bureaus are going to see that you are looking for a home or vehicle, and you shouldn’t have several individual “hard” inquiries at once.

This does not hold true for credit card applications, though, so signing up for several department store credit cards could have your score taking a hit.

And there you have it, six credit myths fully debunked. Ready to learn more? You can check out this handy guide to help improve your score and have your credit work for you.

Vanderbilt is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. Vanderbilt does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.

Article | Budgeting

Article | Home Buying

Article | Home Buying

Stay in the Know

By subscribing, I agree that Vanderbilt Mortgage may contact me by telephone, provide me with marketing communications about Vanderbilt Mortgage products and services, and share my contact information as described in our website terms.